Warren Buffett Financial Statements: A Comprehensive Guide (Updated November 2, 2026)

Breaking News (November 2, 2026): Warren Buffett has transitioned authorship of Berkshire Hathaway’s annual letter to Greg Abel․ Accessing prior years’

statements, often in PDF format, remains crucial for investors seeking historical data and insights․

Berkshire Hathaway’s financial reporting is uniquely positioned within the investment world, largely due to Warren Buffett’s long-standing commitment to transparency, albeit with a distinctive style․ Understanding these reports, frequently available as PDF documents, is paramount for anyone seeking to analyze the conglomerate’s performance and strategy․ For decades, Buffett’s annual letters to shareholders have been as much a commentary on business and economics as they were a formal review of financial results․

However, a significant shift occurred in early 2026, with Greg Abel assuming responsibility for crafting these influential letters․ While the core financial statements – the balance sheet, income statement, and cash flow statement – remain the foundation of analysis, investors are keenly observing how Abel’s approach to communication might evolve․ Accessing historical PDF versions of these reports allows for a comparative study, enabling investors to discern any changes in presentation or emphasis․

These reports aren’t simply a collection of numbers; they offer a window into Buffett’s (and now Abel’s) investment philosophy and decision-making process․ The availability of these documents in PDF format facilitates detailed scrutiny and long-term trend analysis, essential for informed investment decisions regarding Berkshire Hathaway․

II․ The Significance of Warren Buffett’s Annual Letters

For decades, Warren Buffett’s annual letters to Berkshire Hathaway shareholders weren’t merely financial reports; they were highly anticipated treatises on value investing, business acumen, and economic forecasting․ These letters, often distributed alongside the formal financial statements in PDF format, provided crucial context and qualitative insights that numbers alone couldn’t convey․ Investors meticulously analyzed these documents, seeking clues about Buffett’s investment strategy and his outlook on the market․

The letters’ significance extends beyond the financial data․ Buffett used them to explain complex business concepts in a remarkably accessible manner, fostering a strong connection with shareholders․ Now, with Greg Abel taking the helm of letter writing, the focus shifts to understanding how this tradition will be maintained and adapted․ Accessing archived PDF copies of Buffett’s letters allows for a comparative analysis of his style and Abel’s evolving approach․

Studying these historical PDF documents is vital for understanding the evolution of Berkshire Hathaway’s strategy and the enduring principles of value investing championed by Buffett․

III․ Accessing Berkshire Hathaway’s Financial Statements (PDF Format)

Obtaining Berkshire Hathaway’s financial statements, traditionally released in PDF format, is straightforward through several avenues․ The official Berkshire Hathaway website (link to be added) serves as the primary source, hosting current and historical reports within its Investor Relations section․ These PDF documents include the annual report, quarterly filings, and, importantly, Warren Buffett’s annual letters – now authored by Greg Abel․

Alternatively, the SEC EDGAR database (link to be added) provides access to all filings made by Berkshire Hathaway, including 10-K (annual) and 10-Q (quarterly) reports, available for download as PDFs․ This is a reliable source for official, legally required disclosures․

Finally, numerous third-party financial data providers, such as Bloomberg, Reuters, and Yahoo Finance, compile and distribute Berkshire Hathaway’s financial statements in PDF and other formats․ However, always verify the source against the official Berkshire Hathaway website or SEC filings to ensure accuracy and completeness․

III․A․ Official Berkshire Hathaway Website

The official Berkshire Hathaway website (link to be added) remains the most direct and reliable source for accessing their financial statements in PDF format․ Navigate to the “Investor Relations” section, prominently displayed on the homepage, to find a comprehensive archive of reports․ Here, you’ll discover annual reports dating back several years, each available as a downloadable PDF document․

These PDFs contain the complete audited financial statements, including the balance sheet, income statement, and cash flow statement․ Crucially, the website also hosts Warren Buffett’s (and now Greg Abel’s) annual letters to shareholders, offering invaluable qualitative insights alongside the quantitative data․ The website’s layout is generally user-friendly, allowing for easy navigation and efficient retrieval of specific reports․

Regularly checking this website ensures you have access to the latest filings and commentary directly from Berkshire Hathaway․ It’s the gold standard for accurate and up-to-date information presented in convenient PDF format․

III․B․ SEC EDGAR Database

The U․S․ Securities and Exchange Commission’s (SEC) EDGAR database (link to be added) provides another avenue for accessing Berkshire Hathaway’s financial statements in PDF format․ As a publicly traded company, Berkshire is legally obligated to file its reports – including 10-K (annual report) and 10-Q (quarterly report) – with the SEC․

Within EDGAR, you can search for Berkshire Hathaway by its ticker symbol (BRK․A or BRK․B) or its company name․ The search results will display a list of filings, each available as a downloadable PDF․ While EDGAR offers a complete record of filings, the interface can be less intuitive than Berkshire’s official website․

However, EDGAR is valuable for accessing filings directly from the source and verifying the authenticity of the information․ It’s particularly useful for researchers and those requiring access to historical filings beyond what’s readily available on the company’s website․ Remember to confirm the filing type (10-K or 10-Q) to ensure you’re viewing the correct report in PDF format․

III․C․ Third-Party Financial Data Providers

Numerous financial data providers offer access to Berkshire Hathaway’s financial statements, often in convenient PDF formats, alongside analytical tools and data visualizations․ Services like Bloomberg, Refinitiv, FactSet, and Yahoo Finance compile financial data from various sources, including SEC filings and company releases․

These platforms typically provide a user-friendly interface for searching and downloading Berkshire’s 10-K and 10-Q reports as PDF documents․ While many offer free basic access, premium features and extensive historical data usually require a subscription․ These providers often present data in standardized formats, facilitating comparative analysis;

Consider these services if you require integrated financial data and analytical capabilities beyond simply accessing the PDF statements․ They can be particularly helpful for professional investors and analysts․ However, always verify the source of the data and cross-reference with official filings on Berkshire’s website or the SEC EDGAR database to ensure accuracy․

IV․ Key Financial Statements to Analyze

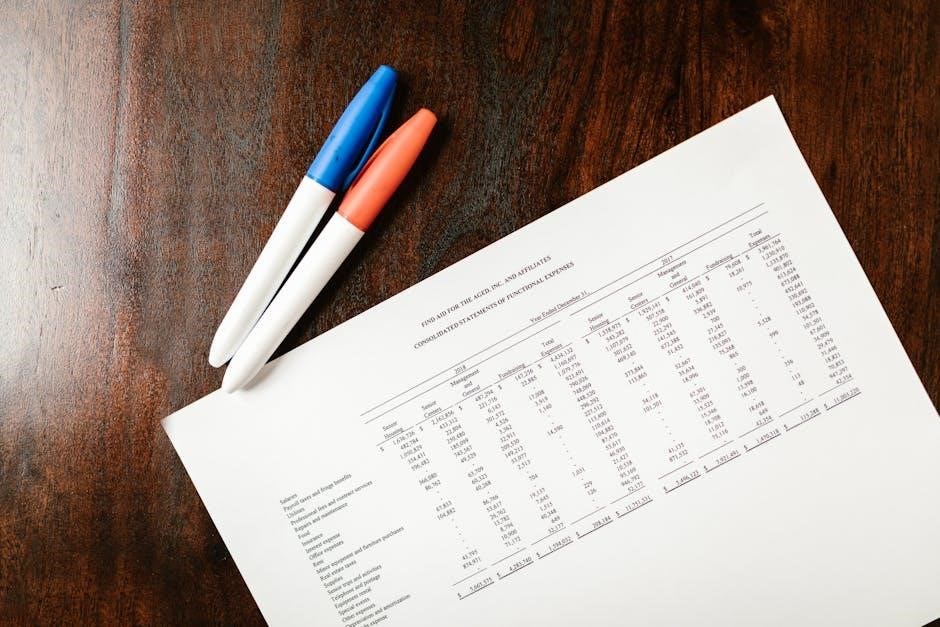

Analyzing Berkshire Hathaway requires a deep dive into its core financial statements, readily available as PDF downloads from the sources mentioned previously․ The Balance Sheet provides a snapshot of Berkshire’s assets, liabilities, and equity at a specific point in time, revealing its financial position․

The Income Statement, also accessible in PDF form, details Berkshire’s revenues, expenses, and profits over a period, showcasing its operational performance․ Crucially, understand the impact of insurance “float” on reported earnings․ Finally, the Cash Flow Statement, downloadable as a PDF, tracks the movement of cash both into and out of the company, indicating its ability to generate cash and fund investments․

These three statements, when analyzed together, offer a comprehensive understanding of Berkshire’s financial health․ Remember to focus on trends over time, rather than single-period results, when reviewing these PDF documents․ Understanding the nuances within each statement is key to evaluating Berkshire’s value․

IV․A․ The Balance Sheet: A Snapshot of Assets and Liabilities

Berkshire Hathaway’s Balance Sheet, typically found as a PDF document on their website or the SEC EDGAR database, presents a crucial overview of the company’s financial standing․ Assets, including substantial holdings in stocks like Apple and significant cash reserves, are listed alongside liabilities, primarily insurance float and debt․

Analyzing the asset side reveals Berkshire’s investment strategy – a concentration in long-term, value-oriented holdings․ The liability side highlights the unique role of insurance operations, where premiums collected create a “float” used for investment․ Examining the equity section, representing shareholders’ stake, provides insight into the company’s net worth․

When reviewing the PDF version, pay close attention to the composition of assets and liabilities․ Look for trends in cash levels, debt, and the growth of investment holdings․ Understanding these components is fundamental to assessing Berkshire’s financial strength and risk profile․

IV․B․ The Income Statement: Tracking Berkshire’s Earnings

Berkshire Hathaway’s Income Statement, readily available as a PDF via official channels and the SEC, details the company’s profitability over a specific period․ Unlike many corporations, Berkshire’s earnings are heavily influenced by its diverse subsidiaries, particularly its insurance businesses and significant equity investments․

Key items to scrutinize include underwriting profits from insurance operations, investment gains (or losses) from its stock portfolio, and earnings from operating businesses like BNSF Railway and various manufacturing companies․ The consolidated nature of Berkshire means the PDF statement reflects a complex aggregation of numerous entities․

Investors should focus on trends in net earnings, paying attention to the contributions from different segments․ Analyzing the PDF’s details reveals how effectively Berkshire deploys capital and generates returns․ Understanding these earnings drivers is vital for evaluating the company’s overall financial performance․

IV․C․ The Cash Flow Statement: Understanding Cash Generation

The Cash Flow Statement, accessible in PDF format from Berkshire Hathaway’s website and SEC filings, provides a critical perspective on the company’s ability to generate and utilize cash․ This statement categorizes cash flows into three primary activities: operating, investing, and financing․

Berkshire’s substantial insurance operations typically generate significant cash flow from operating activities due to premium collection exceeding claim payments – the “float․” The investing section reveals cash used for acquisitions (a hallmark of Buffett’s strategy) and sales of securities․ Analyzing the PDF reveals how Berkshire funds its growth․

Financing activities, often minimal for Berkshire, show any debt issuance or repayment, and share repurchases․ A strong, positive cash flow from operations is a key indicator of Berkshire’s financial health․ Scrutinizing the PDF’s details helps assess the sustainability of its dividend payments and future investment capacity․

V․ Understanding Berkshire Hathaway’s Unique Structure

Berkshire Hathaway’s financial statements, available as PDF downloads, present a unique challenge due to its complex structure․ It operates as a holding company, owning a diverse portfolio of businesses across various sectors․ This necessitates careful consideration when interpreting consolidated financial results․

The PDF reports detail how Berkshire’s subsidiaries are accounted for, impacting revenue recognition and asset valuation․ A significant portion of Berkshire’s cash comes from its insurance operations, specifically the “float” – premiums held before claims are paid․ Understanding this “float” is crucial when analyzing the PDF’s balance sheet․

The consolidated nature of the statements means results from highly profitable businesses can be offset by those with lower margins․ Therefore, examining individual subsidiary performance (where disclosed in supplemental PDF materials) provides a more granular view of Berkshire’s overall health and investment effectiveness․

V․A․ Holding Company Structure and Consolidation

Analyzing Berkshire Hathaway’s financial statements, often found as detailed PDF reports, requires understanding its holding company structure․ Berkshire doesn’t directly engage in most businesses; it owns controlling stakes in them․ This impacts consolidation practices, as outlined within the PDF disclosures․

Consolidation means Berkshire combines the financial results of its subsidiaries into its own statements․ However, the degree of control dictates the consolidation method․ Full consolidation occurs with wholly-owned subsidiaries, while equity method accounting applies to those with significant, but not complete, ownership․ The PDF notes explain these methods․

Investors reviewing the PDF must recognize that consolidated figures aren’t necessarily indicative of Berkshire’s direct earnings․ Intercompany transactions are eliminated, but understanding the underlying performance of each business unit—often detailed in supplemental PDF filings—is vital for a comprehensive assessment․ The structure adds complexity, demanding careful scrutiny of the notes to the financial statements․

V․B․ Insurance Operations and “Float”

Berkshire Hathaway’s insurance operations are central to its success, and understanding their impact is crucial when analyzing the company’s financial statements, readily available in PDF format․ A key concept is “float”—premiums received from policyholders before claims are paid․ This interest-free loan fuels Berkshire’s investments․

The PDF reports detail the insurance businesses’ underwriting results (profits from premiums exceeding claims and expenses)․ Positive underwriting results contribute to increased float․ However, significant claims events can deplete float, impacting Berkshire’s investment capital․ Scrutinizing the PDF’s claims reserves is therefore essential․

Buffett skillfully deploys this float, generating investment income that significantly boosts Berkshire’s overall earnings․ The PDF statements showcase how effectively float is utilized․ Investors should assess the relationship between float, underwriting profitability, and investment returns to gauge Berkshire’s operational efficiency and financial strength․ Analyzing these elements within the PDF provides a holistic view․

VI․ Analyzing Key Financial Ratios

Successfully interpreting Berkshire Hathaway’s financial statements, often accessed as PDF documents, requires analyzing key financial ratios․ These ratios provide insights beyond the raw numbers, revealing trends and comparisons․ The Price-to-Book (P/B) ratio, detailed within the PDF, is particularly important given Berkshire’s asset-heavy structure․

Return on Equity (ROE), also found in the PDF reports, demonstrates how effectively Berkshire generates profits from shareholder equity․ A consistently high ROE signals strong management and efficient capital allocation․ The Debt-to-Equity ratio, detailed in the PDF, indicates Berkshire’s financial leverage; Buffett traditionally favors a conservative approach․

Investors should compare these ratios over time, using data extracted from historical PDF statements, and benchmark them against industry peers․ Analyzing these ratios within the context of Berkshire’s unique structure—a holding company with diverse businesses—is crucial for a comprehensive assessment․ The PDFs are the primary source for this data․

VI․A․ Price-to-Book (P/B) Ratio

The Price-to-Book (P/B) ratio is a vital metric when analyzing Berkshire Hathaway, and its calculation relies heavily on data found within the company’s financial statements, typically available as PDF downloads․ This ratio compares Berkshire’s market capitalization to its book value, offering insight into whether the stock is undervalued or overvalued․

Berkshire’s substantial holdings in other companies, detailed in the PDF reports, significantly impact its book value․ A P/B ratio below 1․0 might suggest undervaluation, a scenario Warren Buffett often seeks․ However, interpreting Berkshire’s P/B requires nuance, considering its diverse portfolio and the inherent challenges in valuing its subsidiaries, as outlined in the PDF․

Investors accessing the PDF statements should carefully examine the components of book value – assets minus liabilities – to understand the underlying drivers of the P/B ratio․ Tracking this ratio over time, using historical PDF data, reveals trends and informs investment decisions․

VI․B․ Return on Equity (ROE)

Return on Equity (ROE) is a cornerstone metric for evaluating Berkshire Hathaway’s profitability, and its precise calculation depends on figures readily available in the company’s annual financial statements, often distributed as PDF documents․ ROE measures how effectively Berkshire generates profits from shareholder investments․

Analyzing Berkshire’s ROE, sourced from the PDF reports, requires understanding its unique structure․ The insurance “float” – premiums collected before claims are paid – significantly boosts Berkshire’s equity base, influencing the ROE calculation․ A consistently high ROE, detailed within the PDF, indicates efficient capital allocation․

Investors should scrutinize the income statement within the PDF to determine net income and the balance sheet to ascertain shareholder equity․ Comparing Berkshire’s ROE to industry peers, using data compiled from various PDF filings, provides valuable context․ Tracking ROE trends over time, utilizing historical PDF data, reveals the long-term effectiveness of Buffett’s investment strategy․

VI․C․ Debt-to-Equity Ratio

The Debt-to-Equity (D/E) ratio is a vital indicator of Berkshire Hathaway’s financial leverage, and its assessment relies heavily on data extracted from the company’s comprehensive financial statements, typically available in PDF format․ This ratio reveals the proportion of debt financing versus equity financing used by Berkshire․

Berkshire, historically, has maintained a remarkably conservative capital structure, reflected in a low D/E ratio, as detailed in the annual PDF reports․ This cautious approach, championed by Warren Buffett, minimizes financial risk․ Analyzing the balance sheet within the PDF is crucial to determine total debt and shareholder equity․

Investors should compare Berkshire’s D/E ratio, found within the PDF filings, to those of its competitors to gauge its relative financial risk․ A consistently low ratio, documented across multiple years of PDF statements, signals financial stability․ Tracking changes in the D/E ratio, using historical PDF data, can reveal shifts in Berkshire’s financing strategy․

VII․ Greg Abel’s Transition and Future Reporting

The recent transition of the annual letter authorship from Warren Buffett to Greg Abel marks a significant shift, prompting investors to consider potential changes in reporting style․ However, the underlying financial statements – available in PDF format from official sources – will remain the cornerstone of Berkshire Hathaway’s transparency․

While Abel’s narrative approach may evolve, the core financial data presented in the annual PDF reports, including the balance sheet, income statement, and cash flow statement, will continue to provide critical insights․ Investors should continue to diligently analyze these PDF documents․

Accessing historical PDF filings will become even more important for comparative analysis, allowing investors to track trends and assess the impact of Abel’s leadership․ The consistency of the financial data within these PDF reports will be key to maintaining investor confidence․ Expect continued availability of these reports in easily downloadable PDF versions․

VII․A; Impact of Abel Taking Over the Annual Letter

Greg Abel assuming authorship of Berkshire Hathaway’s annual letter doesn’t inherently alter the fundamental financial data presented in the accompanying reports, readily available as PDF downloads․ However, the presentation and interpretive context surrounding those numbers will likely shift․

Buffett’s letters were renowned for their folksy wisdom and qualitative insights․ Abel’s approach may be more direct and data-focused, potentially requiring investors to delve deeper into the detailed financial statements – the PDF reports themselves – for a complete understanding․

Investors accustomed to Buffett’s narrative should supplement their reading with thorough analysis of the PDF financial statements․ The core numbers remain the same, but the interpretive lens has changed․ Accessing and scrutinizing historical PDF filings will be crucial for gauging consistency and identifying any evolving reporting nuances․ The PDF format ensures data preservation and accessibility․

VII․B․ Potential Changes in Reporting Style

While the core financial data within Berkshire Hathaway’s annual reports – accessible in PDF format – will remain consistent, subtle shifts in reporting style under Greg Abel’s leadership are anticipated․ These changes won’t invalidate past analyses based on historical PDF filings, but awareness is key․

Expect a potentially more technical presentation, with less emphasis on Buffett’s anecdotal explanations and a greater focus on quantitative metrics․ Investors should be prepared to independently interpret the numbers presented in the PDF statements․

The depth of discussion surrounding specific investments within the PDF reports might also evolve․ Abel may prioritize different aspects of the portfolio, requiring investors to actively seek information previously highlighted by Buffett․ Downloading and carefully reviewing the complete PDF document will become even more essential․ The long-term availability of these PDF archives ensures transparency and facilitates comparative analysis․

VIII․ Common Mistakes When Analyzing Berkshire’s Statements

Analyzing Berkshire Hathaway’s financial statements, often found in PDF format, presents unique challenges․ A frequent error is applying standard valuation metrics without considering its holding company structure․ Simply looking at consolidated figures in the PDF can be misleading․

Another mistake is underestimating the importance of “float” generated by its insurance operations․ This isn’t free money; understanding its cost and sustainability requires careful review of the PDF’s insurance segment disclosures․

Investors often fail to account for the illiquidity of many Berkshire holdings․ The PDF statements don’t always reflect the true market value if these were to be sold quickly․ Ignoring the historical context provided in prior years’ PDF reports is also detrimental․ Finally, relying solely on summaries and neglecting the detailed notes within the full PDF document can lead to incomplete or inaccurate conclusions․ Thoroughness is paramount when interpreting these complex PDF filings․

IX․ Resources for Further Research

For in-depth analysis beyond the core Berkshire Hathaway PDF financial statements, several resources prove invaluable․ The official Berkshire Hathaway website hosts an archive of annual reports, readily available as PDF downloads, alongside Warren Buffett’s past letters․

The SEC EDGAR database provides access to all filings, including 10-K reports (annual) and 10-Q reports (quarterly), in PDF format․ Websites like Yahoo Finance and Bloomberg offer summarized data, but always refer back to the original PDF filings for accuracy․

Numerous books and articles dissect Berkshire’s strategy and financials․ Seeking out analyses specifically referencing the PDF reports enhances understanding․ Remember to critically evaluate all sources and cross-reference information․ Finally, exploring academic databases can yield research papers analyzing Berkshire’s unique financial structure, often referencing the publicly available PDF documents․